Products

Secure microSD cards

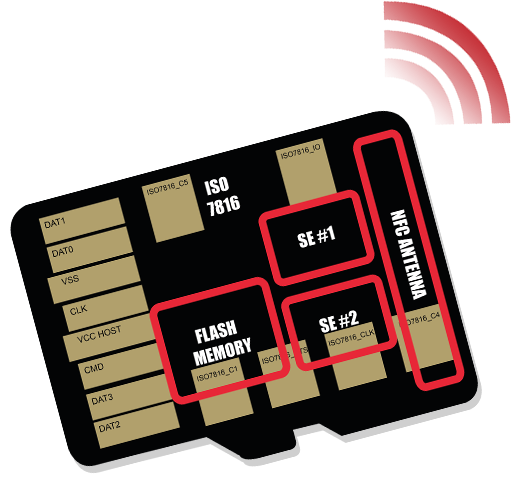

LGM Card

LGM Card is a standard size microSD memory card with built-in NFC antenna and two secure chips.

LGM Card

LGM Card is a standard size microSD memory card with built-in NFC antenna and two secure chips.

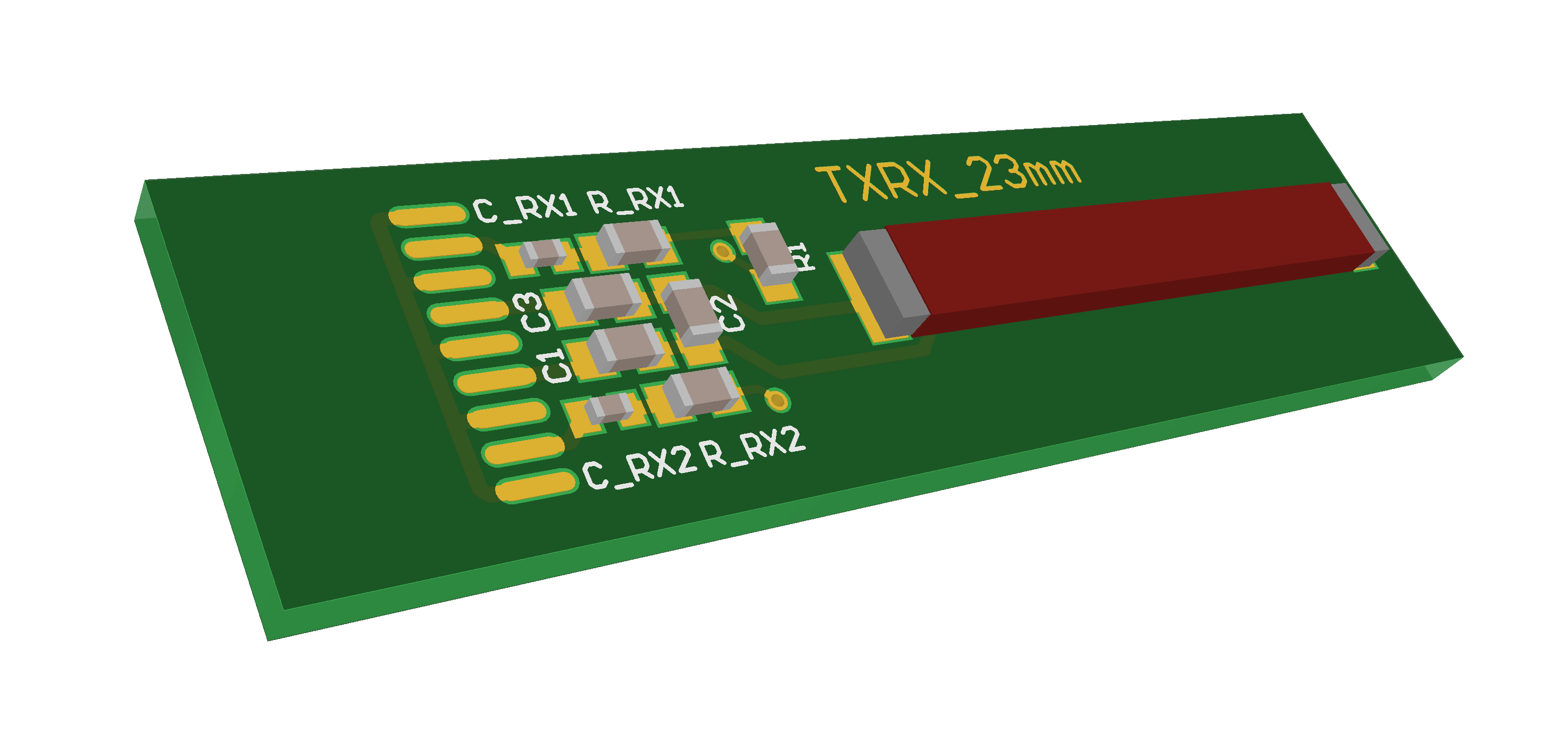

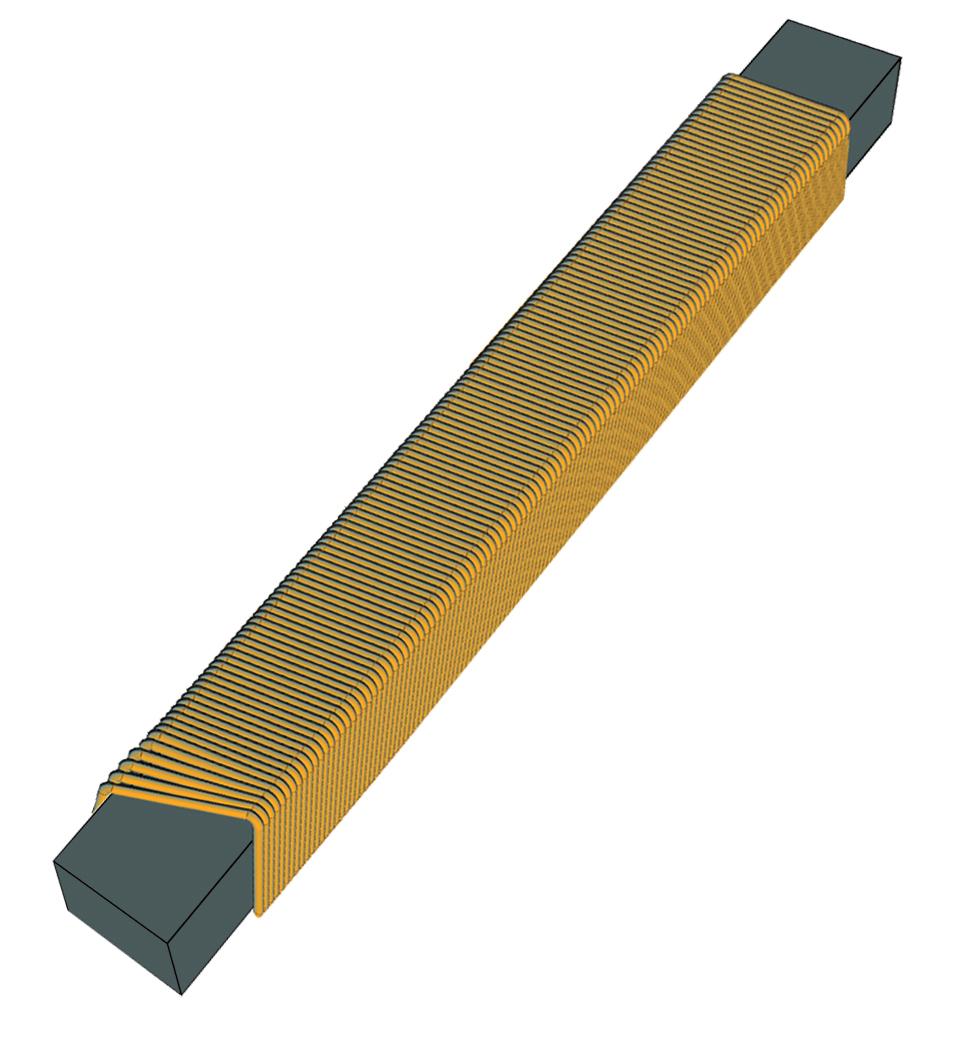

Micro coil NFC Antennas

Micro coil NFC antennas are off-the-shelf NFC antennas that eliminate major considerations for NFC antennas – placement, layout and RF performance

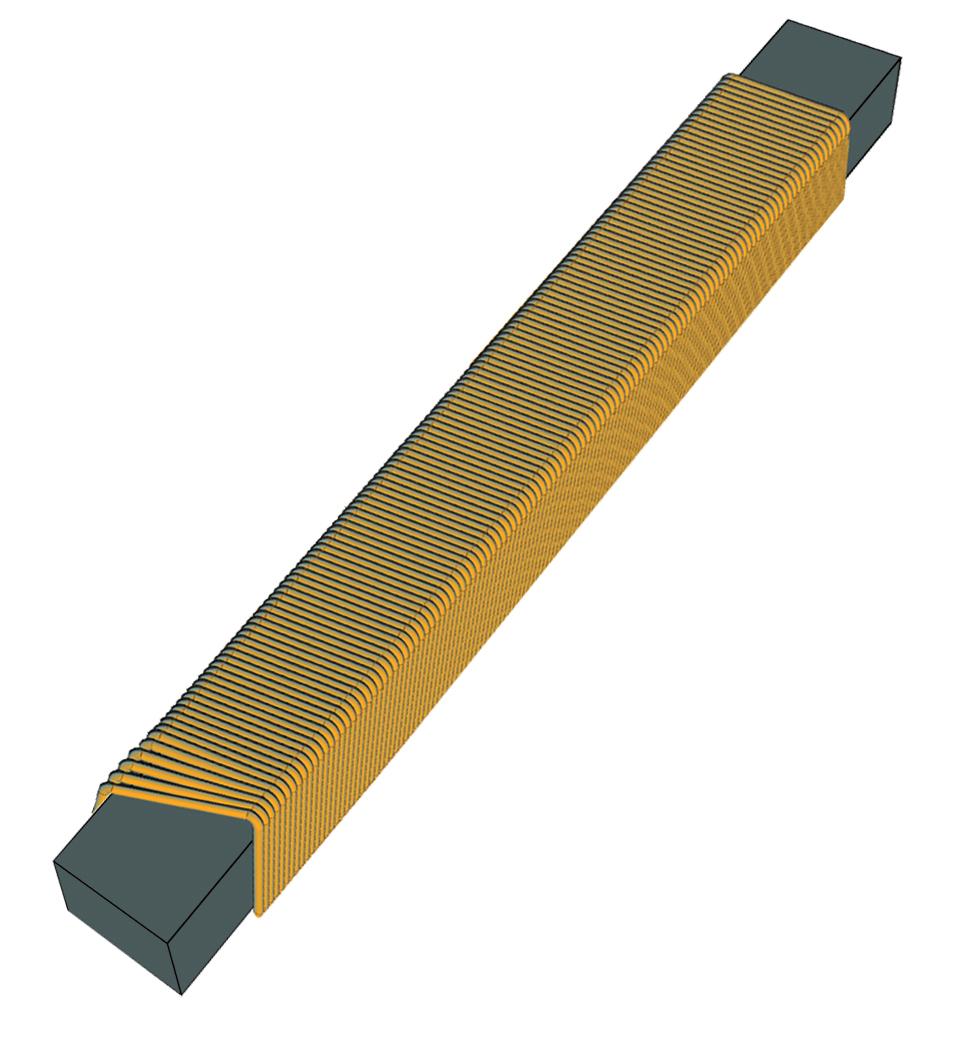

Miniature Coil NFC Antennas

Miniature coil NFC antennas are off-the-shelf NFC antennas that eliminate major considerations for NFC antennas – placement, layout and RF performance

Services

NFC antenna selection

Secure microSD card design

Software development

NFC antenna system design

NFC performance measurements

Consultancy

Contact us

Headquarter:

Logomotion, s.r.o.

Winterova 15

921 01 Piestany

Slovak Republic

Phone: +420 602 725 438

Email: contact@logomotion.eu